I was sitting at my desk at work when I saw the headline that SHEIN had raised $1 billion at a valuation of $100 billion. I kid you not I had never heard of this company and abruptly asked in the middle of the bullpen,

“Has anyone heard of the company ‘shine’ ?”

People looked at me confused as I repeated myself several times and finally the lightbulb went off. Someone said, “do you mean She-in?” I had literally never heard of this company and they had raised money at a valuation of 100 billion dollars. Not a unicorn, not a deca-corn, this is a “hecto-corn” (for 100).

For a triple-digit, billion-dollar valuation, what the heck does SHEIN do?

Well first let’s back up. The fashion industry is an expensive, fast-moving, and complex consumer industry.

Things go in and out of “style” in the blink of an eye. In the digital age, people feel the need to dress well in public, and want to be able to access shopping from the comfort of their own homes, with apps they use already use (looking at you social media apps)

Weather, temperature, and season make many items in people’s wardrobes dependent on factors outside of the consumer’s control

Clothing is expensive and heavily dependent on raw materials, cost and availability of labor, supply chain robustness, inflation, and more; all of which have been challenged over the last few years.

According to ResearchandMarkets.com, the global clothing and clothing accessories market is expected to grow from $1.2 trillion in 2020 to $1.5 trillion in 2025. SHEIN focuses primarily on fast fashion, but who says they can’t expand?!…..

SHEIN is a B2C fashion e-commerce retailer that aims to make luxury fashion products accessible to everyone at ludicrously cheap prices. What’s more, they are able to get those clothes to you before any other blue-chip fashion brand can. This is what fast fashion is all about, getting trendy pieces of clothing that received attention and popularity from catwalks or celebrities into the hands of consumers at breakneck speeds. Consumers can wear these items a few times while they are at peak popularity and then discard them.

How do they do this?

Well, SHEIN has a super interesting and unorthodox model, but one that makes a ton of financial sense when you think about it

Like other fashion brands, SHEIN designers track social media and runway shows extremely closely to see what is getting attention and interest.

Many of you may be thinking, well don’t other brands do something similar to this? What makes SHEIN special?

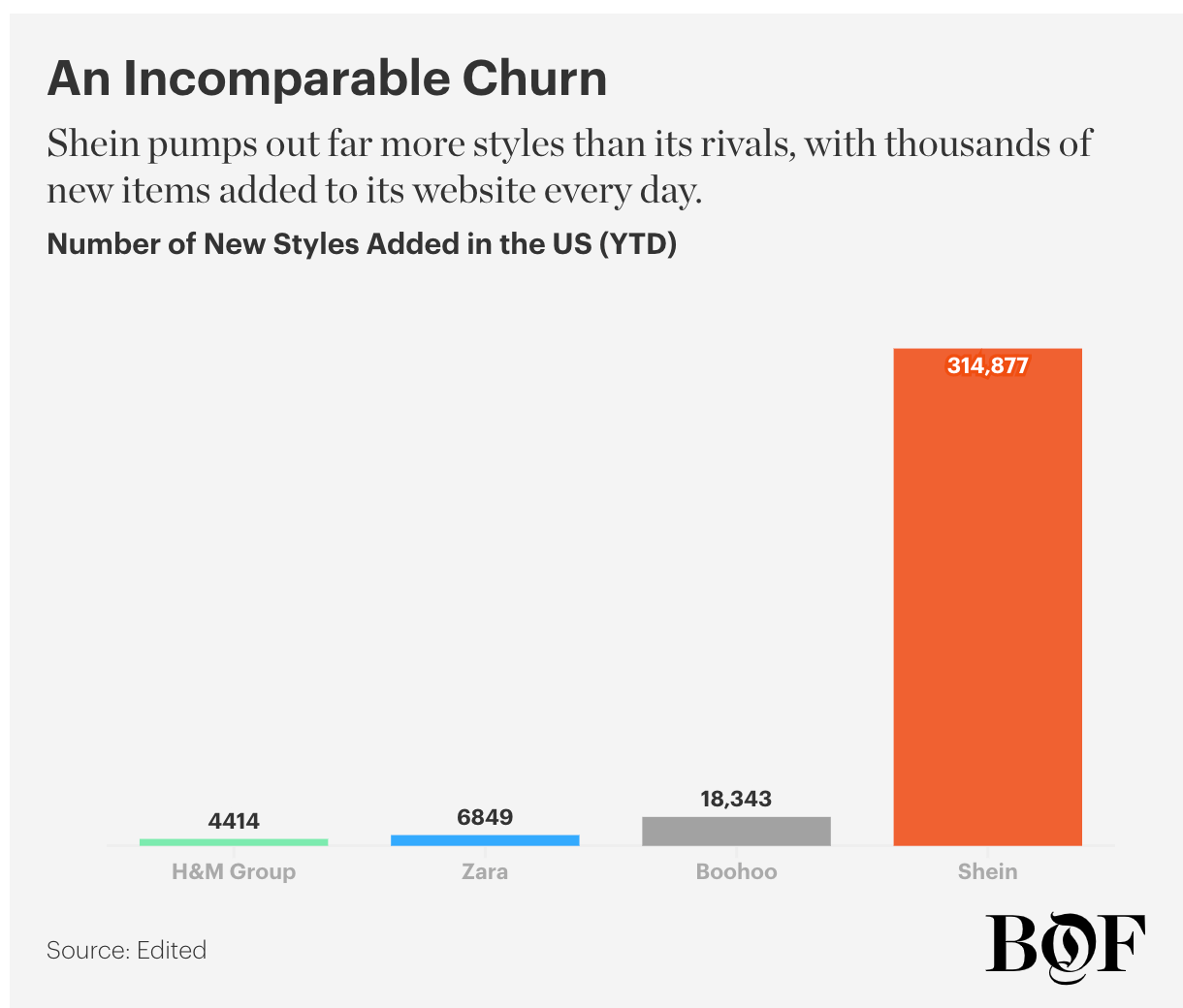

Where SHEIN differentiates itself is the speed at which it can act upon consumer data and interest. SHEIN uses extensive data science and algorithms to identify what is trending online so that they can get those ideas to a designer and drawing board as soon as possible. They also push out far more items than brands like Zara and competitors.

According to an article on Observer:

Shein drops 1,000 new products every day (Zara releases 500 new designs every week). Most of [SHEIN’s] are priced between $8 and $30. That’s 30 percent to 50 percent less than comparable pieces sold by Zara and H&M.

I decided to check this out for myself. Here’s the number of new items every day according to SHEIN’s catalog:

4/11 - 6,257 new items (I am writing this on 4/11, so they released this many designs today, on the same day!!!)

4/10 - 4,460 new items

4/9 - 6,852 new items

4/8 - 7,836 new items

4/7 - 7,192 new items

4/6 - 6,701 new items

4/5 - 6,788 new items

That is 46,086 new items in just the last 7 days… This implies 2.4 million items listed in 52 weeks…..

Continuing to stay at the forefront of what is trending and how to identify it is going to continue to be a top priority for SHEIN. As a result, as of this writing, SHEIN’s job site has 94 job listings. 33% of those are related to engineering, IT, project management, and supply chain.

As soon as a trend is identified and a slew of items is drawn up, they are shipped directly to the production floors of SHEIN’s intensive network of more than 6,000 suppliers across many production facilities based in Guangzhou, China. How do they do this so rapidly? Factories that work with SHEIN are forced to use SHEIN’s enterprise resource planning systems (ERP), software that manages financials, supply chain, operations, commerce, reporting, manufacturing, and more. So SHEIN can determine what is trending, design an item based on it, and then communicate orders and demand with factory floors directly and without human intervention, in real-time.

SHEIN then produces these items in tiny batches, sometimes 1/10th the volume of what comparable retailers produce, and lists them for users to purchase. The pieces that get the most clicks and purchases, they immediately put in for mass production, and those that don’t, they cut from the brand’s catalog entirely.

‘They can ramp up production fast and that’s where their real-time aspect works. Shein can see how many people are looking at an item, how many people are putting it in their cart, and how many people are sharing it on social media. Once it hits a certain threshold, the factory manager receives a message on their phone telling them to make more. There’s no human interaction – it’s all automated, which is impressive.’

By gauging demand with small batches of new items, they take almost no inventory risk ($ and waste) and can use real data to determine which pieces to produce at a larger scale at a second’s notice. They don’t have any physical stores but don’t need it either; SHEIN has an enormous social media presence with tremendous marketing and cheap prices. The world of fashion moves quickly, things go in and out of favor instantly, and SHEIN’s demand-based model is poised to capitalize on this speed.

What’s more, SHEIN doesn’t pay any taxes on clothing shipments to the USA as the Trade Facilitation and Trade Enforcement Act of 2015 sets a standard of any import up to $800 per person is duty-free. This improves SHEIN’s cost structure and margins.

And then, once all of the above happens, the network effects start kicking in.

Sure there are extensive advertisements, influencers, and more all at the companies disposal to promote products, but SHEIN’s customers do the advertising for them. Many customers post Tik Tok’s or Youtube videos showing their “SHEIN hauls” and promoting what they took home that particular day. Customers also benefit from a highly sticky loyalty program in which they can earn store credit for things as simple as logging into their account on a daily basis, which is not only another source of data but also encourages repeat business. And on the flywheel turns…

Some other crazy SHEIN facts:

#shein on tiktok has 25 billion views

SHEIN boasts 250 million followers across its social media channels.

SHEIN makes Amazon and Zara look overpriced…. A shopper can browse for clothes in ludicrous categories such as “under $5”, “under $10”, “under $15”. Some of the “flash sale” items, which kick off everyday at 4PM ET are up to 65% off… think you get the points. The homepage boasts free shipping for orders over $9.90, free returns, 10% off your first order, buy 2 get 50% off, flash sales, clearance sales and more.

SHEIN’s mobile app ranks within the top 5 apps in 10 markets

SHEIN’s data has only been bolstered by the power of social media and leveraging celebrity collaborations with well-known musicians (Katy Perry, Nick Jonas, Lil Nas X, Tinashe), influencers (Addison Rae), and reality TV stars (The Bachelor’s Hannah Godwin, The Only Way Is Essex’s Amber Turner), and more.

The “no” inventory, demand-based supply model is brilliant.

But to produce what is supposed to be “hyper luxurious products” for less than a sandwich in Murray Hill ($9), I have to believe there are some corners being cut.

Many of my friends who are familiar with the company say that the quality of the clothing is extremely poor and is really meant for single-time use. Additionally, shipping times are absurdly long (sometimes more than 30 days). But if you build it, they will come, and people will buy the clothing they like if it is priced at a point that they can afford.

Unfortunately, their environmental and labor practices are a large topic of concern. Good on You, a world-leading source of trusted brand ratings on ethical and sustainable fashion, rates SHEIN as “very poor” for a multitude of reasons. I could list them myself but would rather show than tell:

SHEIN uses few eco-friendly materials. There is no evidence that it has taken meaningful action to reduce or eliminate hazardous chemicals. There is no evidence it reduces its carbon and other greenhouse gas emissions in its supply chain. There is no evidence it has a policy to minimise the impacts of microplastics.

Its labour rating is 'very poor'. None of its supply chain is certified by labour standards which ensure worker health and safety, living wages or other labour rights. It received a score of 0-10% in the 2021 Fashion Transparency Index. There is no evidence it implements practices to encourage diversity and inclusion in its direct operations or supply chain. There is no evidence it ensures payment of a living wage in its supply chain. It does not disclose adequate policies or safeguards to protect suppliers and workers in its supply chain from the impacts of COVID-19.

Its animal rating is 'not good enough'. There is no evidence it has a policy to minimise the suffering of animals. It uses wool and exotic animal hair. It does not use leather, fur, down, angora or exotic animal skin. There is no evidence it traces any animal products to the first stage of production.

This is a pretty dark review for a company that just raised at a $100 billion valuation from some big-name venture firms. What’s even crazier is at $100 billion, SHEIN sits close to both private and public companies SpaceX, Stripe, VW, Airbnb, Boeing, ServiceNow, and even Goldman Sachs.

Additionally, SHEIN faces risks from supply-chain struggles, China / USA trade relations, and criticism from environmentalists and sustainable fashion supports. I was under the impression that “stealing” designs or ideas from other brands/designers was illegal but America’s totally archaic copyright laws actually have allowed SHEIN and others to “copycat” each other with ease.

It will be interesting to see if SHEIN will continue to rocket in the universe of sky high valuations or if the risks associated with it will force a reconsideration of the model.

Dr. Strange 2 is in theaters this week and I might need to start a food blog already.

This week I had the pleasure of cheffing for work and college friends. I went for baked clams (pictured, shoutout Soph), spicy rock shrimp, and some sweet potatoes. Also had the opportunity to cook squid for the first time which I tossed into a salad.

Jumped around some rooftops with friends Saturday and finished off the day with a number of back-to-back stand-up comedy routines including Aziz Ansari, Ronny Chieng, Dave Chapelle, and Judd Apatow.

For the Disney & Marvel adults subscribed, the finale of Moon Knight comes out tomorrow (5/4) and Dr. Strange 2 is out Thursday (5/5). Got a lot of entertainment on my to-do list, expect a few reviews next week.

GW